Keeping consumer data safe without breaking the experience

- Justin Pike

- Sep 11, 2025

- 3 min read

We are often met with scepticism when we say that consumers typically prefer a little friction in the payment process - things like tapping a card and entering a PIN. And I know this sounds counter-intuitive in an era where everything else is moving towards seamless, one-click experiences. But in payments, friction equals security. And in a world where e-commerce fraud grew 140% in the US last year, who wouldn’t want safer transactions?

Building an ecosystem of trust

Mastercard’s recent eBook The common good: Creating an ecosystem of transactional trust, makes it clear that trust isn’t built in isolation. It’s an ecosystem shared between consumers, merchants, and issuers. Each party has different needs, but they all want the same outcome: strong protection, easy transactions, and a sense of confidence that the system works for them.

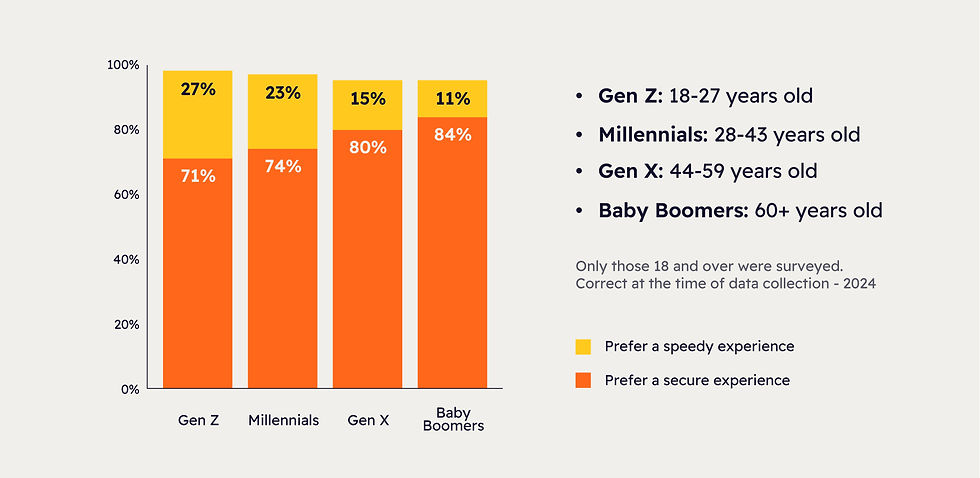

The research shows that 77% of consumers prioritise security over speed when shopping online, and that figure rises to 79% when using financial services.

Security clearly matters most. But… add too much friction, and the balance tips, leading to what Mastercard calls experience decay. Nearly one in three consumers (28%) have abandoned an online transaction because it simply took too long.

Source: The common good: Creating an ecosystem of transactional trust by Mastercard

Data sharing: the currency of trust

One of the strongest findings is that consumers are prepared to play their part. 77% would share more data with merchants, and 76% would share more with financial institutions, if it helped combat fraud.

Issuers appear to be leading the way here: 63% share additional data on all transactions, compared to just 30% of merchants. That gap represents both a risk and an opportunity. The more data flows securely across the ecosystem, the better fraud can be prevented, and the stronger the trust loop becomes.

Fraud and the erosion of trust

Fraud isn’t just a financial cost; it’s also a reputational one. 92% of consumers would trust a company less, and 91% would stop using it altogether, if they experienced fraud. That is existential risk.

Source: The common good: Creating an ecosystem of transactional trust by Mastercard

And fraud takes many forms. Beyond cybercrime, first-party or ‘friendly’ fraud, which is where consumers dispute genuine transactions, accidentally or maliciously, is costing organisations an estimated $50 billion annually. And so, merchants and issuers are responding with more identity verification, AI-powered detection tools, and risk-based customer checks. But the reality is clear: fraud eats away at consumer confidence unless tackled head-on.

The opportunity for issuers and merchants

So how do you keep consumer data safe without breaking the experience? In my opinion, the answer is very simple: by shifting e-commerce transactions from card-not-present risk to card-present assurance, with CPoI®.

Turn friction into assurance CPoI® enables the gold standard of EMV card-present security in digital environments. Every online payment becomes the same high-assurance event as a tap in a supermarket, with categoric proof of cardholder identity. This eliminates the need for clunky, repeated re-authentication while still delivering the confidence consumers want.

Communicate security with clarity Consumers are reassured when they know their data is safe. With CPoI®, merchants and issuers can clearly demonstrate that each transaction is protected by EMV-grade validation, and not just by more steps in the checkout. That transparency builds trust and reduces abandonment.

Close the data gap CPoI® creates an inherent trust signal between cardholder, merchant, and issuer. Because authentication is native to the transaction, it reduces the need for data-sharing and secondary verification tools, eliminates false positives, shrinks fraud losses and protects interchange revenue.

Address fraud at the root Cybercrime, friendly fraud, false positives all stem from uncertainty about who the customer really is. CPoI® removes that uncertainty by making every online purchase card-present. That means fewer chargebacks, fewer disputes, fewer operational costs, and stronger loyalty.

Why this matters now

Consumers want fast, simple, and safe payments. Merchants want frictionless checkouts and higher conversion rates. Issuers want to reduce fraud, protect interchange, and retain loyalty.

The common ground?

Trust.

When issuers and merchants invest in secure, seamless experiences and collaborate to protect consumer data, everyone wins.

At Burbank, that’s where we focus: reducing fraud, protecting cardholder data, and ensuring that the next wave of digital commerce is safer, smoother, and stronger than ever.

Comments